Our clients ask us to provide a level of insight that will enable them to make informed decisions. That insight goes far deeper than accounting diligence.

Due Diligence

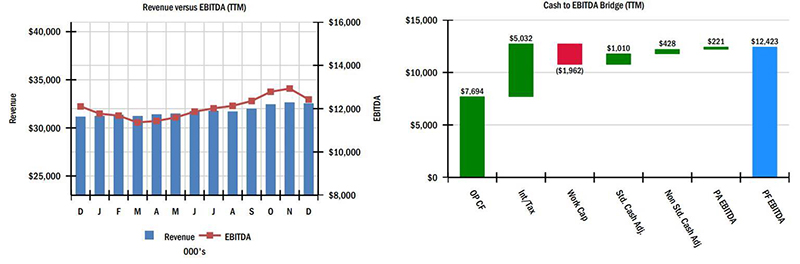

With PE Perspective, we strip down and rebuild the financials from the ground up and present them in a manner that our clients are used to seeing on every transaction. That creates tremendous efficiencies. Same schedules, same formats, same meaningful characterizations of revenue momentum, contribution margin or flow-through, fixed cost leverage, and operating cash flow. Our clients see many different businesses across a wide range of industries. It only makes sense to provide a tool that accelerates the realization of value by standardizing the approach, thus maximizing client resources and time. Once we have rebuilt the financials, we address GAAP earnings and reconcile cash flow to EBITDA to ensure we collectively understand the cash flow history and characteristics of the business.

Portfolio Monitoring

Our clients ask us to run along-side them in parallel throughout the investment. PE Perspective® gives our clients the insight they need.

When Things Aren’t Going So Well, We Get Questions Answered

“Why is this company not generating any cash?”

“Sales are up, now where’s our flow-through?”

“The monthly package is just not cutting it.”

“They comped down again and they can’t explain why.”

“We need division level metrics. The MD&A is a little light.”

Sell-Side

Our clients ask us to ensure that each Company is ready for sale. No valuation surprises. Refine and optimize the information flow and anticipate diligence bottlenecks in order to accelerate the process.

No Valuation Surprises

– Preparation of a Quality of Earnings Analysis to understand valuation risk

– Analysis of adjusted working capital to anticipate a target and develop a strategy

– Validation of Management Addbacks with reconciliation to source documentation

Optimize Information Flow

– What were the bottlenecks on the buy-side, let’s anticipate them on the sell-side

– PE Perspective® integrates disparate analyses into a comprehensive monthly file

– Ensure accountants organize the financial datasite and not investment bankers

The private equity industry is unique in that timing and the holding period are critical to success and measuring returns. In short, PE Perspective® maximizes the efficiency of a private equity firm and shortens the time to close upon sale.